How to get a Health Insurance Policy even after surviving diseases like cancer? If you are looking for the answer to the question of whether someone who has any life-threatening disease will get health Insurance or not? The answer is Yes! One can get a health insurance policy but the disease should be completely cured then only he /she will get a health insurance policy.

First of all, let us see what factors and terms and conditions are there in such cases. On the Galaxy health insurance website, we provide the complete information.

What are threatening instances?

It is a very serious medical condition that can be fatal and can end life if left untreated or unmanaged. Examples are cancer, heart disease, stroke, severe infections, liver failure, kidney failure, and other critical illnesses.

Policy for People Who Have Life-threatening Disease

Let’s take an example in which condition an individual can get a health Insurance policy even if he or she has a life-threatening disease like Cancer, Liver transplant, or Kidney transplant. Let’s say a person has cancer and after chemoradiation, medication, and surgery have cured cancer. Now a person is completely out of medication, chemo anything. a person can get health insurance.

Now check the second condition where a person had a heart bypass or open heart surgery or has gone through a kidney transplant after he has been cured, and now he is completely in 100% recovered condition and has no disease related to the same.

After that, the doctor gives you a clean cheat because you’re right now in a healthy condition there is an option available in the market and a person can purchase a health insurance policy.

Which Health Insurance Policy Can an Individual Buy After Cancer, Liver or Kidney Transplant, or After Heart Attack?

Very few companies offer a plan in such conditions, one I can suggest that is a very good plan for such people is the Care Freedom Plan from Care Health Insurance company. The name in itself suggests freedom! You Know It Gives You

Freedom from this worry. Before you buy the Care Freedom Plan, you must check and read the terms and conditions of the policy wording.

What’s the most important thing to look for?

One must know these important points before buying the plan.

- There will be permanent exclusion and no coverage will be provided for that disease from which a person has recovered, like a person who recovered from the heart attack the heart-related disease will not be covered and there will be a permanent exclusion for that in the policy.

- A cancer survivor can buy the Care Freedom policy but the policy will not provide coverage for cancer. Similarly for other critical illnesses.

- There will be Disease-specific sub-limits, let’s say a person buys the policy of 10 Lakh sum insured, but he or she can not claim for 10 Lakh Rs, there will be disease sub-limits.

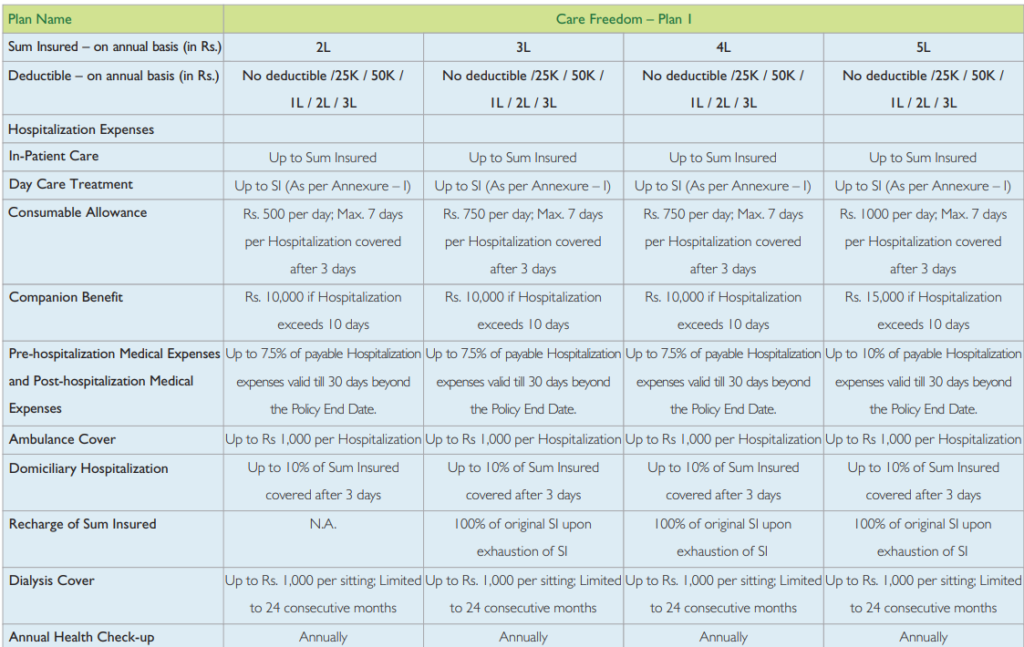

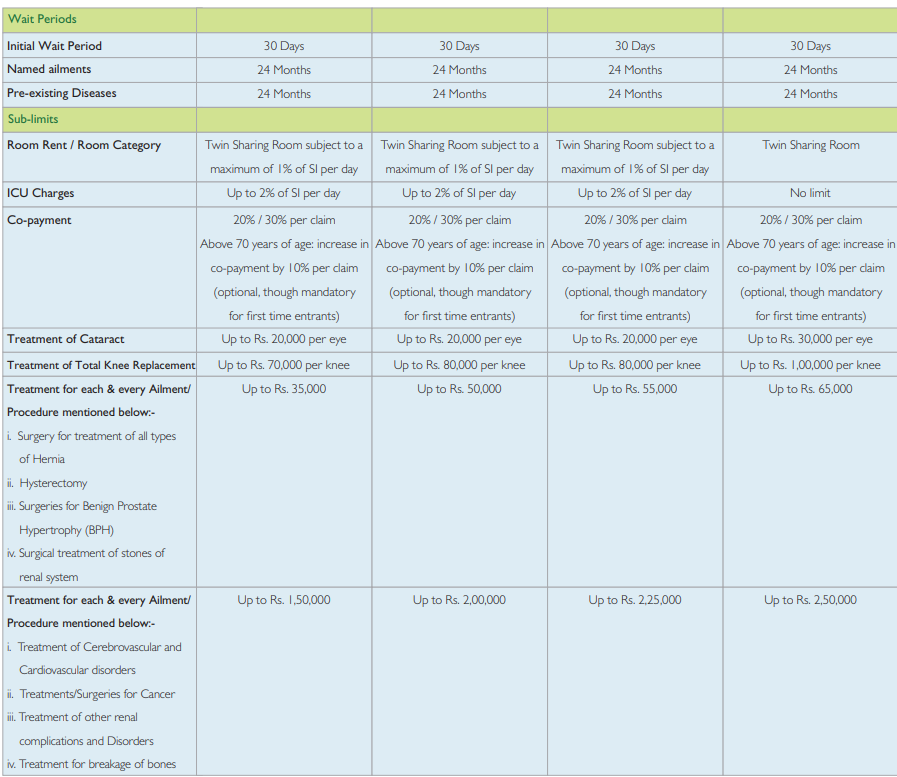

Care Freedom Sub-limits and Plan Details

Disease-Specific Sublimits in Care-Free

Please note that there are sub-limits and co-pays for the Health Insurance Policy Even After Surviving Diseases Like Cancer, but still in my opinion there is some shield for the coverage. Please note the company can change the policy wording and terms and conditions at any point in time, It is always recommended to read the policy wording and terms and conditions before buying the policy.

FAQ

Can a person buy a Health Care policy even after Liver Transplant?

Yes! there is a health insurance plan in the market, a person can buy the Care Freedom plan but liver failure or disease will not be covered.