Can Diabetics Get Health Insurance in India in 2024? We all know that diabetes is associated with the lifestyle of an individual, and due to lifestyle changes, even the younger generation is acquiring diabetes. As we all know diabetes is just not a disease it’s the root of many diseases in such conditions maintaining the perfect lifestyle and having the best health insurance for diabetes patients in India is a must, as the medical cost is rising in India day by day.

Most of the diabetic people ask me if is diabetes covered under health insurance. I am also a diabetic patient and being an Insurance professional here in this post, I will share the right answer to your query Can Diabetics Get Health Insurance in India in 2024?

The answer is Yes! a diabetic person can get health Insurance in India in 2024! Now the insurance companies are offering health insurance policies for diabetics in India. Diabetes is covered by insurance companies in India, and the selection of the best diabetes health insurance plan is a must while purchasing the policy, if you purchase the wrong policy you may not get the mediclaim for a diabetic patient. Thus I am sharing my personal experience here, let’s find out which health insurance is best for diabetics in 2024.

Can diabetics get health insurance in India?

Yes! Getting health insurance with diabetes is just a click away, And diabetes is covered under health insurance from day one of the policy when you buy the Energy Plan of the HDFC ERGO. Below I am going to share the best health insurance for diabetics in India in 2024.

Which health insurance is best for diabetics?

The Energy Plan health Insurance from HDFC ERGO is one of the best health insurance for diabetic patients, It’s my personal opinion based on the features of the plan and the trust that I have in the HDFC ERGO brand.

This is one of the best health insurance for diabetic patients in India that not only covers your condition and complications but also helps you to live with diabetes peacefully.

Features of the Energy Plan – The Best Diabetic Health Insurance Policy Plans.

The energy plan from HDFC ERGO is one of the unique plans that has the following features which are very useful for the patient with diabetes.

- Active Wellness Program – Wellness program to help you monitor and manage your health.

- No waiting Period – Get coverage from day one for all hospitalizations arising out of diabetes and hypertension.

- Get Reward points to get a discount on future premiums by staying healthy.

- Energy plan is the health insurance for type 1 diabetes in India. The best diabetes type 1 health insurance plan covers all complications related to diabetes and hypertension from day one.

Know the basics of the Energy plan

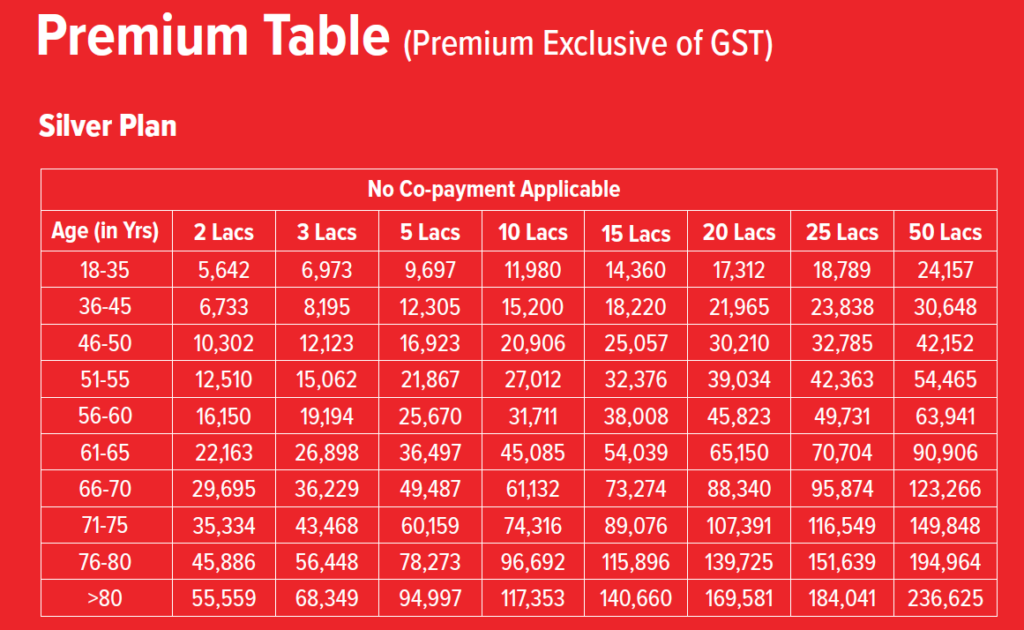

- The entry age is 18 to 65 years and for those who are suffering from type 1 or type 2 Diabetes.

- The plan can be issued to an individual only and can be taken for the sum insureds of Rs. 2,00,000; 3,00,000; 5,00,000; 10,00,000; 15,00,000; 20,00,000; 25,00,000 and 50,00,000.

- The options are mentioned below:

- Silver plan: cost for wellness tests is excluded

a. Without Co-pay

b. With 20% Co-pay* - Gold plan: cost for wellness tests is included

a. Without Co-pay

b. With 20% Co-pay

Why the Energy plan health insurance policy for diabetic patients is best?

As mentioned earlier, before buying a health insurance plan for a diabetic person one should understand the policy and its benefits in detail. Here we are sharing the complete details which you should read carefully before making an informed decision.

The health coverage benefit of the Energy Plan

- No waiting period policyholder will get day one coverage for all hospitalizations arising out of diabetes and hypertension.

- In-patient hospitalisation.

- Pre and post-hospitalization cover 30 and 60 days respectively.

- Medical expenses for daycare procedures.

- Emergency ambulance coverage.

- Organ donor expenses.

- Shared accommodation benefit.

- HbA1C check-up benefit.

- Restore Benefit.

- Cumulative Bonus.

Special wellness program designed to manage your health

- Wellness Tests: Two complete medical checks administered during the policy year.

- Wellness Test 1: HbA1c, Blood Pressure Monitoring, BMI.

- Wellness Test 2: HbA1c, FBS, Total Cholesterol, Creatinine, HighDensity Lipoprotein(HDL), Low-Density Lipoprotein (LDL), Triglycerides (TG), Total Protein, Serum Albumin, Gamma-Glutamyltransferase (GGT), Serum Glutamic Oxaloacetic Transaminase (SGOT), Serum Glutamic Pyruvic Transaminase (SGPT), Bilirubin, Total Cholesterol: HDL Cholesterol, ECG, Blood Pressure Monitoring, BMI, Doctor Consultation.

Wellness Support for the Diabetic Patient who holds the Energy Plan.

- Access to a personalized wellness web portal that tracks your medical values from various tests, stores all your medical records, helps you monitor your condition, and provides you with special o ers for health products that you may need.

- Monthly newsletters to provide you with important information on healthcare and management.

- Access to a centralized helpline to answer any queries that you may have.

The reward for staying healthy for Diabetic Plan Policy Holder.

Based on the results of your medical tests and key health parameters such as BMI, BP, HbA1c and Cholesterol HDFC ERGO offers you incentives for staying healthy.

- Renewal premium discounts of up to 25% for management of health conditions.

- Reimbursement of up to 25% of renewal premium towards your medical expenses (like consultation charges, medicines and drugs, diagnostic expenses, dental expenses, and other miscellaneous charges not covered under any medical insurance)

What are the Exclusions in Energy Plan for Diabetic Persons?

The exclusions are mentioned below please read carefully before choosing the right health insurance for the diabetic person.

- Any pre-existing condition (other than diabetes or hypertension) will be covered after a waiting period of 2 years.

- Congenital external diseases, cosmetic surgery

- Abuse of intoxicant or hallucinogenic substances like intoxicating drugs and alcohol.

- Hospitalization due to war or an act of war or due to a nuclear, chemical, or biological weapon and radiation of any kind.

- Pregnancy, external aids, and appliances.

- 2-year waiting period for specific diseases like cataracts, hernias, joint replacement surgeries, surgery for hydrocele, etc.

- Non-medical expenses

- Experimental, investigative, and unproven treatment devices and pharmacological regimens.

How much does health insurance cost for a diabetic in India?

The cost of health insurance for a diabetic depends on several parameters which are mentioned below.

- The company from which you are buying the policy. Always check the claim settlement ratio of that company.

- The entry age of the person for which you are buying the policy.

- Previous health policy claim status.

- Whether you are buying a new policy or opting for the portability of the previous policy you are holding.

- What is your health condition how much is your HbAc1 and which medicine you are taking at present?

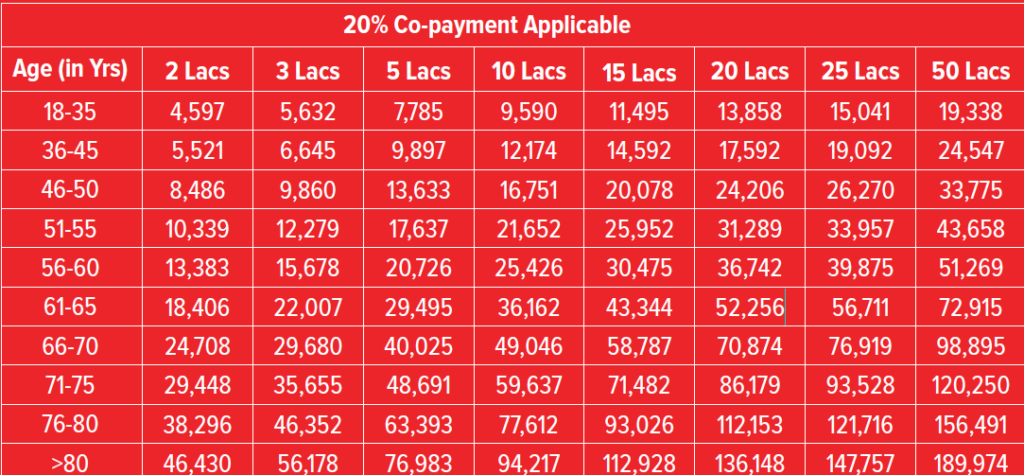

The tentative cost of the health Insurance plan for Diabetics in India is given below, this cost is for the Energy Plan the Health Insurance policy from HDFC ERGO for Diabetic persons from 18 years to 65 years.

Health insurance cost for a diabetic in India with Co-payments.

FAQ

Is diabetes covered by health insurance?

Yes! Health insurance offers special plans for diabetic persons and there are special health policies that cover diabetic and hypertension related any health issues from day one.

Can you get health insurance with diabetes?

Yes! One can easily buy Health insurance policy even though he or she is suffering from type 1 or type 2 diabetes.