Let’s look at the Galaxy Health Insurance Share Price driving factors and understand the growth potential. We are sharing Galaxy Health Insurance company reviews that will help you understand how the company share will perform in the future.

The Insurance Regulatory and Development Authority of India (IRDAI) has recently approved the Galaxy Health and Allied Insurance Company Limited to carry out health insurance business in India.

Mr. V. Jagannathan, who was the founder of Star Health and Allied Insurance Company has left Star Health Insurance and now started another inning where he has collaborated with TVS and formed a new company by the name of Galaxy Health and Allied Insurance Company Limited.

How to Buy Galaxy Health Insurance Share in India?

It is a newly established company with the head office located in Chennai. If you want to know where you can buy the Galaxy Health Insurance share? Please note you can buy the share when it gets listed in NSE or BSE in India or from unlisted Grey Zone.

Still, Galaxy Health and Allied Insurance Company Limited does not yet have publicly listed the shares. Keep watching for the IPO of Galaxy Health Insurance which is going to be released soon in the coming months. To understand how company share will perform you should know What is Galaxy Health Insurance Cost in India? How much revenue company can generate?

Should you buy Galaxy Health Insurance Share?

Here we are sharing the insight and personal review that we have drawn from the background of its founder Mr. V. Jagannathan and the present market condition of the Health Insurance market in India, which will decide the Galaxy Health Insurance Share Price.

- Mr. V. Jagannathan founded and led Star Health to profitability

- He successfully launched an IPO for Star Health.

- The experience and proven track record of success of Mr. V. Jagannathan in the health insurance industry in India, are likely to benefit the new Galaxy Health Insurance venture in India.

- In recent years the growth rate of the Health Insurance sector in India has exceeded 30%, and the rapid growth in the Health insurance sector makes it the right choice of sector for investment.

- In the current fiscal year, total health insurance premiums are expected to cross ₹1 lakh crore, Industry is booming and there is a huge potential.

- Recently IRDA has reduced the waiting periods for pre-existing conditions, the regulatory environment has become more favorable for health insurers like Galaxy Health Insurance.

Partnership with TVS will also have a positive impact on Galaxy Health Insurance Share Price.

The joint venture is going to benefit both organizations and help in revenue generation which will have a positive impact on Galaxy Health Insurance. Share Price.

- Financial strength – TVS is the profitable group that gives financial strength to the newly launched Galaxy Health Insurance and Allied Services.

- Customer Base: TVS has a huge customer base who has purchased motor insurance from them through distributors or dealers network which can be used to sell health insurance products of Galaxy Health Insurance.

- The company can have the type with all TVS 2-wheeler distributors and dealers to sell the Health insurance policy to all 2-wheeler purchasers as an attachment product. This is the quickest and most cost-effective way to develop the distribution channels for Galaxy Health Insurance in India.

When the policy acquisition cost is low and ALR (Average Loss Ratio) is under control Galaxy Health and Allied Insurance Company Limited will be profitable. When the company’s fundamentals and earnings are high the Galaxy Health Insurance Share price will be high and give good returns to the investors.

Galaxy Health Insurance being a newly launched company does not yet have any publicly available financial data or share price information. The future share price and performance of Galaxy Health Insurance Share depend on its ability to effectively capitalize on the growing health insurance market in India.

Health Insurance Share Price in India.

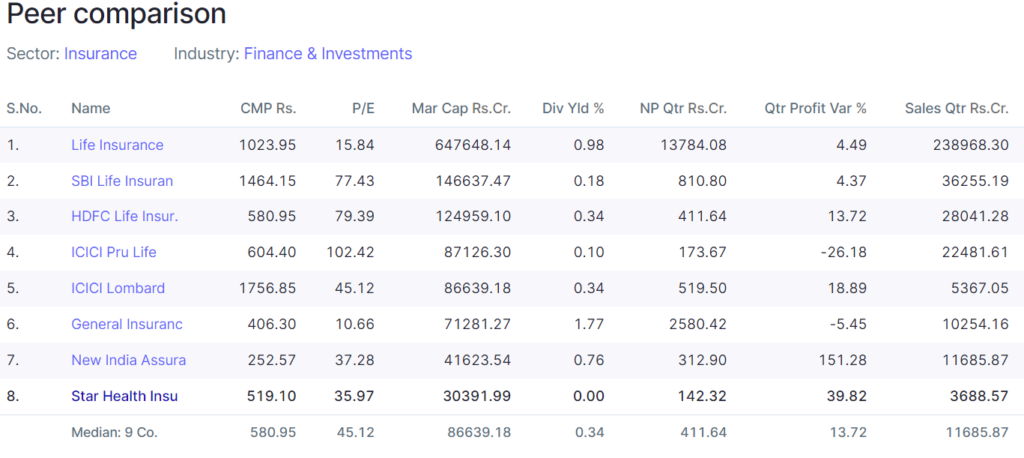

Please have the Peer comparison to estimate the Galaxy Health Insurance estimated share price.

Soon the IPO will be released and you can buy Galaxy Health Insurance share price online. Please do not consider it as a piece of financial advice, consult your financial advisor before you invest in Galaxy Health Insurance Share in India.

1 thought on “Galaxy Health Insurance Share Price Driving Factors”