Should You Buy Health Insurance from Policybazaar? Answer is Yes! but before taking any decission read the complete blog post to understand the pros and cons of buying policy from Policybazaar or directly.

Health insurance is no longer a luxury, it’s a necessity. With medical inflation soaring and hospitalization costs skyrocketing, having a robust health insurance policy is crucial to safeguard your savings. But the real challenge lies in choosing the right policy and deciding where to buy it from.

Should you purchase health insurance directly from the insurer’s website, through an agent, or via an online aggregator like Policybazaar?

In this detailed guide, I’ll share:

✔ My personal experience with Policybazaar while buying a policy for my mother (65+ years)

✔ Pros and cons of buying from Policybazaar vs. directly from insurers

✔ Price comparison, commissions, and negotiation tips

✔ Best practices to avoid policy rejection & claim disputes

✔ FAQs on buying Health Insurance from Policybazaar.

Why Should You Buy Health Insurance?

- Rising Medical Costs

A single hospitalization can wipe out years of savings. A heart surgery can cost ₹5-10 lakhs, cancer treatment can go up to ₹20 lakhs+, and even a simple appendix operation can cost ₹1-2 lakhs. - Financial Security for Family

If you’re the sole earning member, a medical emergency can disrupt your family’s finances. Insurance ensures cashless treatment without draining your savings. - Coverage for Critical Illnesses

Many policies now cover critical illnesses like cancer, kidney failure, and stroke with lump-sum payouts. - Tax Benefits (Section 80D)

₹25,000 (for self & family) and ₹50,000 (for senior citizens)

Who Should Buy Health Insurance?

| Category | Why They Need It |

|---|---|

| Young Professionals | Early entry = Lower premiums, lifelong coverage |

| Families with Kids | Protects against child hospitalization costs |

| Senior Citizens | Higher medical needs, pre-existing conditions |

| Self-Employed | No employer group insurance backup |

My Personal Experience While Buying Health Insurance from Policybazaar – A Cautionary Tale

Background

I needed health insurance for my mother (65+ years). She had a history of Esophageal Varices (a condition linked to liver cirrhosis) and underwent surgery for it.

Policybazaar Executive’s Assurance

I explained her medical history to the Policybazaar agent.

He recommended Care Health’s “Supreme Care” policy, assuring no issues with approval.

He claimed, “Just buy it, the policy will be issued without problems.”

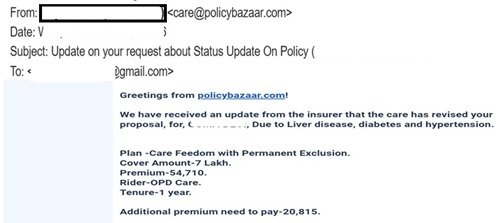

Payment & Shock Rejection

I paid the premium (~₹38,000).

The underwriting team rejected the application.

Instead, they offered a “Care Freedom” policy with exclusion of liver-related diseases.

Lack of Clarity on Exclusions

I asked, “What exactly is excluded?”

The executive couldn’t answer clearly.

Since Esophageal Varices is linked to liver disease, any future claim could be denied under the pre-existing condition clause.

Key Takeaways from My Experience Of Buying Health Insurance from Policybazaar

✔ Agents prioritize sales over suitability – They may not fully assess medical underwriting risks.

✔ Pre-existing conditions can lead to claim rejection – Always verify policy wordings.

✔ Policybazaar is just a mediator – Final approval lies with the insurer.

Policybazaar vs. Direct Purchase vs. Agent – Which is Better?

1. Buying from Policybazaar (Online Aggregator)

✅ Pros:

✔ Multiple insurers in one place

✔ Quick comparison of features & prices

✔ Sometimes offers discounts

❌ Cons:

✖ Risk of mis-selling (as in my case)

✖ Agents may not fully explain exclusions

✖ Commission-driven recommendations

2. Buying Directly from Insurer’s Website

✅ Pros:

✔ No middleman = Lower premium possible

✔ Direct communication with insurer

✔ No mis-selling risk

❌ Cons:

✖ No hand-holding support

✖ Need to research policies yourself

3. Buying Through an Agent

✅ Pros:

✔ Personalized advice

✔ Helps in claim settlement

❌ Cons:

✖ High commissions (10-20%)

✖ May push expensive policies

Price Comparison & Commission Structure

| Purchase Method | Commission Cost | Who Pays? | Can You Negotiate? |

|---|---|---|---|

| Policybazaar | 10-15% of premium | Included in premium | Ask for discounts |

| Agent | 15-20% of premium | Included in premium | Demand free add-ons |

| Direct (Insurer Website) | Zero | No extra cost | Not applicable |

How to Negotiate?

✔ Ask for discounts (some insurers offer 5-10% off online).

✔ Demand free add-ons (like OPD cover, no-claim bonus protection).

Best Practices to Buy the Right Health Insurance

✔ Disclose All Medical History

- Non-disclosure = Claim rejection.

- Even if the agent says “Don’t worry, just buy”, insist on proper underwriting.

✔ Read Policy Wordings Carefully

- Check:

- Waiting period for pre-existing diseases (usually 2-4 years)

- Room rent sub-limits (some policies cap at 1-2% of sum insured)

- Exclusions (e.g., liver disease, knee replacement)

✔ Verify with Insurer via Email

- Example:

- “Dear [Insurer], My mother has a history of Esophageal Varices. Will this be covered, or are liver-related conditions excluded?”

✔ Check Claim Settlement Ratio

- Above 90% is good (IRDAI publishes this data).

✔ Avoid Last-Minute Purchase

- Underwriting takes time. Don’t wait for an emergency.

FAQ – Health Insurance Purchase Doubts Solved (Policybazaar Edition)

1️⃣ Is Policybazaar safe for buying health insurance?

✅ Yes, but verify policy details directly with the insurer. Agents may not always assess risks properly.

2️⃣ Should I buy from Policybazaar or directly?

✅If you understand policies well, buy directly from the insurer.

✅If you need help comparing, use Policybazaar but confirm terms with the insurer.

3️⃣ Can I trust Policybazaar executives?

✅Yes but,they are sales-driven, so always cross-check policy terms yourself.

🚨 Caution: Policybazaar agents work on commissions and may push policies that aren’t the best fit for you. Always double-check policy wordings, exclusions, and terms directly with the insurer.

4️⃣ How can I avoid claim rejection if I buy through Policybazaar?

✔ Disclose all medical history—never hide pre-existing conditions.

✔ Read the policy document carefully before making a purchase.

✔ Confirm coverage and exclusions via email with the insurer before buying.

5️⃣ Which is better – Policybazaar or an agent?

Policybazaar: More options, better price comparison, but risk of mis-selling.

Agent: Personalized service and claim support, but higher commissions and possible bias toward expensive policies.

6️⃣ Is it safe to buy health insurance from Policybazaar?

✅ Yes, Policybazaar is a legitimate platform for comparing and purchasing health insurance. However, don’t blindly trust the agents—always verify policy details directly with the insurer to avoid surprises.

7️⃣ Should I buy health insurance from Policybazaar or directly from the insurer?

Policybazaar: Great for comparing multiple policies, but be cautious of sales-driven recommendations.

Direct from insurer: No middleman, often lower premiums, but requires more research on your part.

8️⃣ Who should buy health insurance through Policybazaar?

✔ If you are tech-savvy and can independently verify policy details.

✔ If you want to compare multiple policies quickly.

✔ If you are comfortable handling claims without agent support.

9️⃣ Should I buy health insurance from Policybazaar or directly from the insurer?

Policybazaar: Great for comparing multiple policies, but be cautious of sales-driven recommendations.

Direct from insurer: No middleman, often lower premiums, but requires more research on your part.

Final Verdict: Should You Buy Insurance from Policybazaar?

✔ Good for comparison, but not for blind trust.

Use Policybazaar to compare policies, but finalize only after verifying with the insurer.

❌ If you need expert advice, consult an independent insurance advisor instead of relying solely on Policybazaar agents.

My Recommendation:

🔹 For tech-savvy buyers → Buy directly from insurer’s website.

🔹 For those needing guidance → Use Policybazaar for research but confirm details via email.

💬 What your experience with Policybazaar for buying Health Insurance?

Share your experience in the comments! Let’s help others make informed decisions.

💡 Final Tip: Use Policybazaar for research and price comparison, but always verify details directly with the insurer before purchasing.

🚑💡 Stay insured, stay secure!